Retailer Goes Here >>>

Get Your Tax Refund

Now your visit to Indonesia can be more enjoyable. The Indonesian government has provided a facility for a tax refund if your purchase goods in any shop (retailer) with the "Tax Refund for Tourists" logo. Please feel free to visit any Indonesian shop (retailer) with the "Tax Refund for Tourists" logo and enjoy your shopping time. Pay Less and Get the Best.

Video: How to claim the Tax Refund

What is "the Tax Refund for Tourist"?

Tax Refund for Tourists is a facility given by the Indonesian government which allows tourist (foreign passport holders) to claim back Value Added Tax (VAT) on goods purchased in any store registered as a "Tax Refund for Tourists" participant.

Who is eligible for a Tax Refunds Scheme?

Any foregin passport holder who is not an Indonesia citizen or not a Permanent Resident of Indonesia, who lives or stays in Indonesia no longer than 60 days upon her/his arrival.

Frequently Asked Questions

- Can I apply Tax Refund from any retailer in Indonesia?

No, you can only apply fot Tax Refund from retailer with "Tax Refund for Tourists" logo on it. - What if I stay for more than 60 days in Indonesia?

Am I eligible for the Tax Refund?

No, Tax refund can only be given to a tourist/foreign passport holder who lives or stays in Indonesia for a maximum of 60 days from the date of entry into Indonesia.

Please be advised that to make your payments eligible for refund, your payments should be completed within one month prior to your departure date leaving Indonesia. - What if I buy goods from retailer shop with "Tax Refund for Tourists" logo and those goods are shipped by carrier companies? Am I eligible for Tax Refund?

No, Tax refund can only be given to a tourist/foreign passport holder who carries on the goods as accompanied baggage out of Indonesia. - Is it possible to purchase goods with several payment receipt and be eligible for Tax refund facilities?

Yes, as long as your minimum Tax amount per receipt is Rp50.000 (fifty thousand rupiah) and the sum of tax from several receipt should comply a minimum of Rp500.000 (five hundred thousand rupiah). - How can I find out which shop (retailer) has been registered as a "Tax Refund for Tourists" participant?

Please check the DGT website at www.pajak.go.id

How to claim the Tax Refund?

Accompanied baggage (goods)

To be eligible for the Tax refund:

- goods must be purchased from shop with “Tax Refund for Tourists" logo across Indonesia by showing your passport, and you must have a valid tax invoice (a tax invoice attached with one payment receipt) from the shop.

- minimum Tax payment is Rp50.000 (fifty thousand rupiah) per transaction and the sum of tax from several receipt should comply a minimum of Rp 500.000 (five hundred thousand rupiah).

- goods are purchased within 1 (one) month before departing Indonesia.

- goods must be carried out of Indonesia as accompanied baggage within 1 (one) month (30 calender days) of the date of purchase.

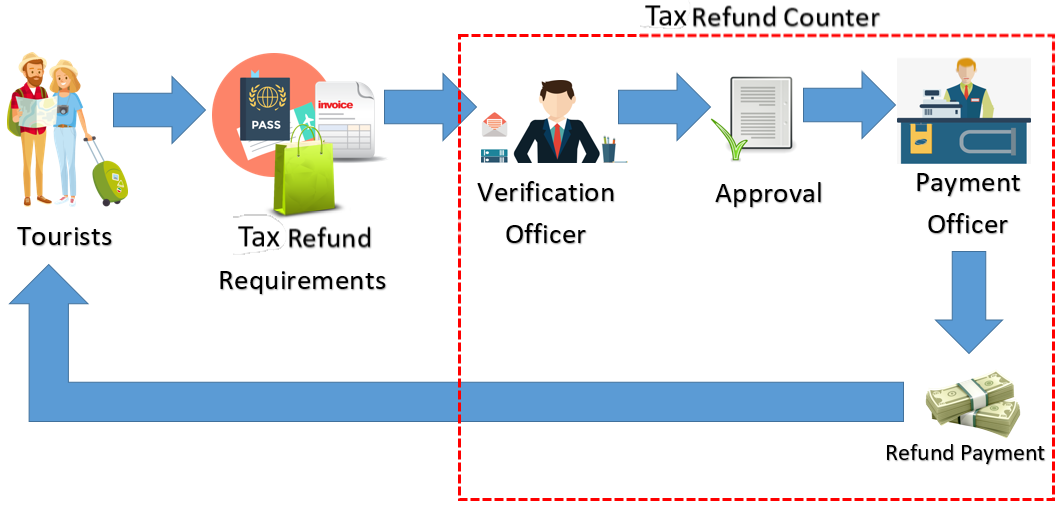

Tax Refund Workflow

Tax refund payment options

Tax refund can be given in cash or transfer:

- By cash in Indonesia Rupiah (IDR) currency.

Tax refund is given in cash only if the amount does not exceed Rp5.000.000 (five million rupiah); - By transfer to your bank account:

When the amount of Tax refund exceed Rp5.000.000 (five million rupiah), the refund will be made by transfer. The passenger should provide bank account number; account name, address, bank routing number, designated bank for transfer and requested currency for the Tax refund. The transfer will be done within one month of receipt of application for Tax refund.

Claim procedure

Tax refund can only be claimed at the airport on the date of your departure and you must follow these steps:

Prepate Your Tax Refund Claim

- Access URL https://vatrefundapp.pajak.go.id/ using your phone/laptop

- Sign in or create new account for new account

- Go to menu “refunds” and create new refund claim

- Fill in address, deparature and arrival date

- Select invoice you want to claim the refund

- Chose refund methods

- Take a picture of your goods

- Click Submit

Go to the Tax Refund Counter

- Show passport, boarding pass and the purchased goods

- Received tax refund by cash or transfer to your bank account

Download Manual User How to get VAT Refund

When can I get my Tax Refund?

Your Tax refund will be refunded in cash on the date of departure at Tax Refund counters before departing Indonesia or within 1 (one) month if you requested payment by transfer.

Where are the Tax Refund counters located?

Tax Refund counters are located in selected Indonesian international airports.

Currently, Tax Refund counters are available at:

| AIRPORT | COUNTER LOCATION | WEBSITE |

|---|---|---|

| Kualanamu, Medan | Departure Terminal, 2nd Floor | kualanamu-airport.co.id |

| Soekarno-Hatta, Jakarta

Counter #1 |

Terminal 2F, International Departure, 2nd Floor | soekarnohatta-airport.co.id |

| Soekarno-Hatta, Jakarta

Counter #2 |

Terminal 3, Gate 1, 2nd Floor | soekarnohatta-airport.co.id |

| Yogyakarta International Airport, Yogyakarta | Departure Terminal | https://yogyakarta-airport.co.id |

| Juanda, Surabaya | Terminal 2, Ground Floor | juanda-airport.com |

| Ngurah Rai, Denpasar | International Terminal, 3rd Floor | www.baliairport.com |

Explore Indonesia

- 70016 kali dilihat